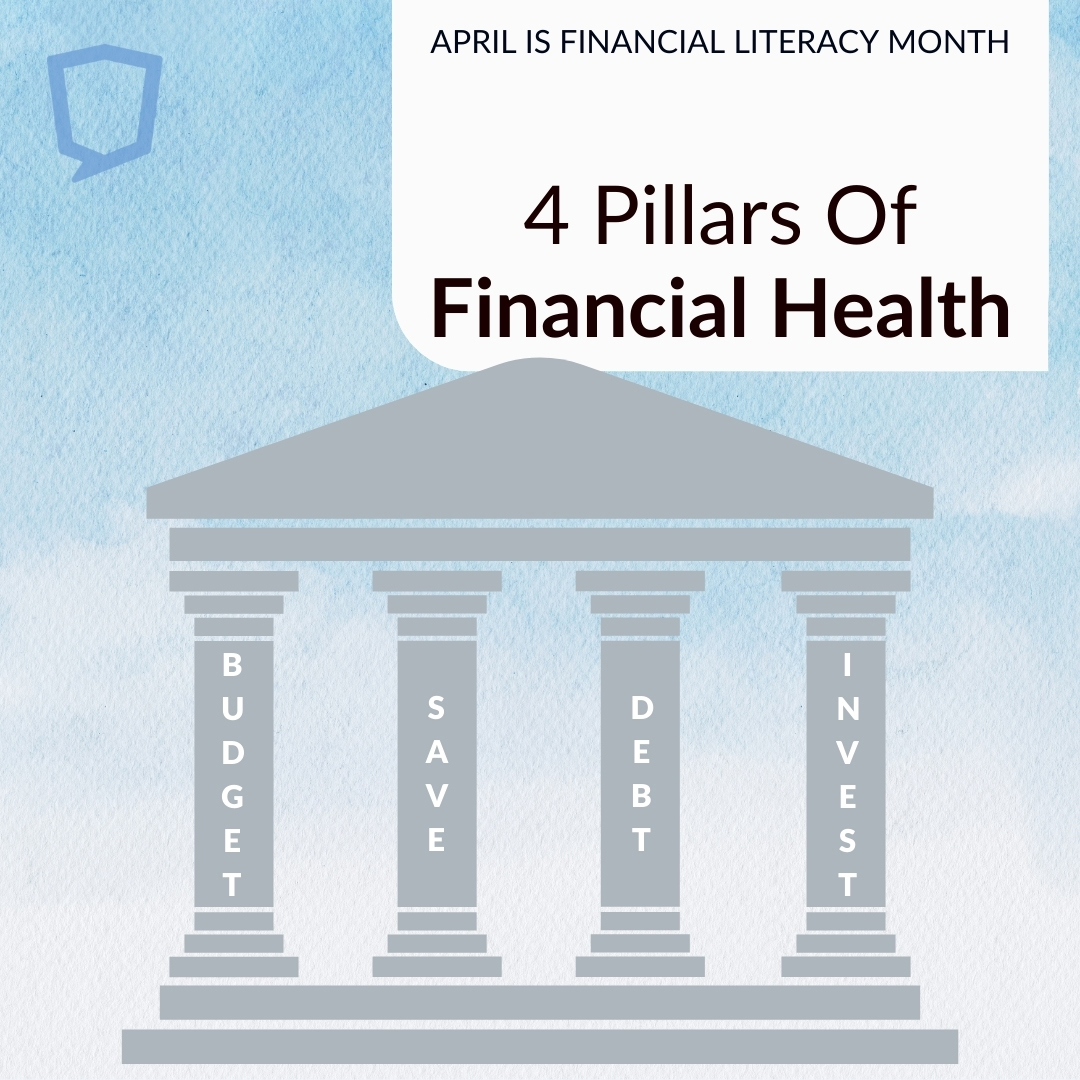

- Debt management. Tackle debt strategically to safeguard your financial well-being. Craft a plan to chip away at existing debt and regain control.

- Budgeting. Create a roadmap for your money by aligning your spending habits with savings goals.

- Saving. Secure your future by setting aside funds, whether it’s for short or long-term goals. Explore options like an emergency fund, mutual funds, and more.

- Investing. Potentially enhance your savings by putting funds toward stocks, bonds, and real estate.

- Risk management (bonus!). Assess and mitigate potential risks to your financial stability. Whether through insurance or income diversification, be sure to protect yourself against life’s uncertainties.

Building a firm financial foundation is your shield against life’s challenges. It all starts with these pillars!

Core Bank offers a free Personal Finance Management Tool, a digital money management resource integrated into online banking and our mobile app, helping you stay on top of your finances by aggregating all of your accounts in one place. With customized budgeting features, smart expense tracking, and mobile access, you can manage your finances easily and securely from anywhere.