Did you know that companies worldwide lost an estimated $534 billion in revenue in 2025?* Ignoring fraud isn’t just risky, it’s costly.

When businesses don’t keep up with fraud tactics and trends, they lose the ability to spot warning signs before it’s too late. Smart business owners understand that awareness is the first line of defense. Pair that awareness with real action—like securing accounts and tightening processes—and you send a clear message: your business is not an easy target.

*https://newsroom.transunion.com/h2-2025-global-fraud-report/#

TOPICS COVERED:

- Fraud Statistics

- Top Risks for Business Owners

- Don’t Let This Happen to You: Real Fraud Examples

- Ten Quick Physical and Digital Steps to Strengthen Your Business

The Stats Speak for Themselves: Fraud Is Everyone’s Problem

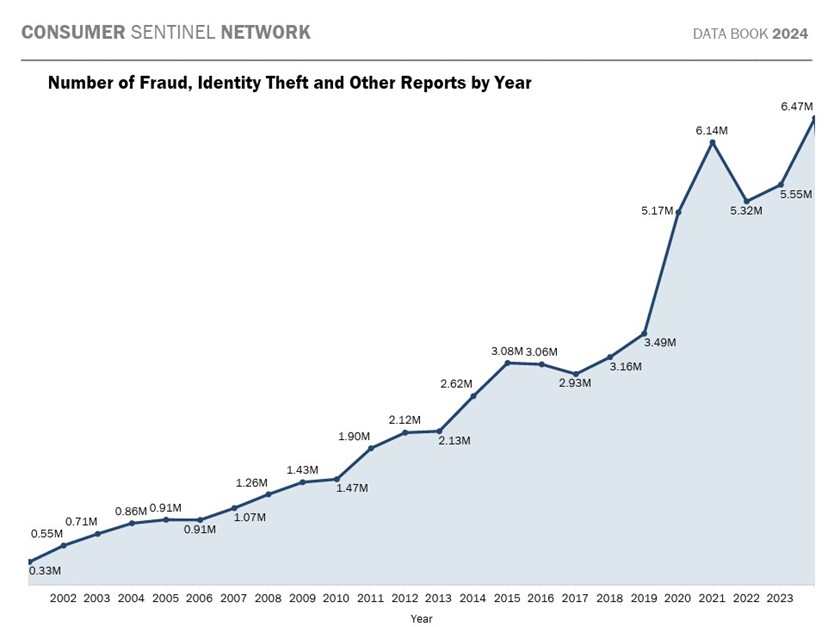

The below graph shows the trajectory of consumer fraud reports from 2001 to 2024.

Your customers have enough to worry about. Don’t lose their trust by allowing your business to fall prey to a scam and potentially risk leaking their confidential information. Smart business owners and individuals recognize that prevention is always better than cure—and the consequences of a fraudulent attack (for both businesses and customers) are far too costly a risk.

What Are The Top Risks For Business Owners?

Business Email Compromise (BEC)

Criminals establish a relationship with an employee by crafting convincing emails – ultimately deceiving employees into believing they are a business partner or even a fellow employee. They then will (typically) target high-level employees who have the authority to transfer funds in order to make away with huge sums.

Corporate Account Takeover (CATO)

Criminals obtain electronic access to your bank account by stealing the confidential security credentials of your employees and conducting unauthorized transactions. Losses from this form of cyber-crime range from the tens of thousands to millions of dollars with the majority of these thefts not fully recovered.

Don’t Let This Happen to You: Real Fraud Examples

The impacts of Business Email Compromise can be devastating, as evidenced in this article written by Proofproint. The results of BEC scams vary, and some businesses even experienced millions in losses. Some of the examples in the article include:

-

Eagle Mountain City’s officials grew accustomed to receiving requests for large payments for vendors, and sent $1.13 million to vendor impersonator.

- A cyber criminal spoofed a vendor’s email, diverting $3.6m of funds from the Children’s Healthcare of Atlanta.

- A Business Email Compromise Gang, (yes, cybercriminal gangs exist!), targeted 50,000 companies in 150 countries.

- …and more.

When you protect your business, you protect your customers too. In many instances where trust is broken, customers will look for a company that takes their privacy seriously.

Other risks to businesses include:

Invoice or Billing Email Fraud

Fraudsters send fake emails to employees pretending to be trusted vendors to intercept payments

Phishing & Malware Infections

Emails with dangerous links or attachments transfer viruses to your computer when clicked.

Asset Misappropriation

Internal theft of cash, inventory, or equipment

Payroll Fraud

Employees exaggerate hours, falsify attendance, or enlist accomplices to inflate their payroll

Read more examples to be aware of on our Cybersecurity and Fraud Prevention Webpage.

A NOTE ABOUT SOCIAL MEDIA

In today’s digital world, it’s easy for attackers to figure out who works where and what employees’ job titles are (thanks, LinkedIn!). Having a social media profile isn’t inherently bad, but it does make you more visible—and that information can be used against you. Awareness is key: understand how your online presence can become a tool for fraudsters.

Ten Steps to Strengthen Your Business

PHYSICAL STEPS

- Schedule Regular Security Trainings With Your Employees

Knowledge is the best weapon! Make your meetings interesting by reading real-world examples - Secure Entry Points

Install locks or access control systems for areas with sensitive information or money - Get A Shredder

Prevent dumpster divers from gaining sensitive information inside discarded mail or old documents. - Clean Desk Policy for Employees

Ensure no sensitive information is left out after hour - Install Security Cameras

Having a few extra sets of eyes is never a bad idea, and usually just having them deters criminals. If you’re going to do this though, you might want to consider improving the lighting around these areas

DIGITAL STEPS

- (You’ve Heard it a Million Times) Use Better Passwords

The best way to make a strong, long password that you can remember is to make your password a sentence. Test you password strength here to see exactly how long it would take hackers to crack your password: http://passwordmonster.com/ - Stop Hitting “Remind Me Later” on Those Updates – Regularly Update Your Software & Systems

Those annoying updates often come with patches that stitch up any digital vulnerabilities in your software. It’s worth the restart! - Enable Multi-Factor Authentication (MFA) for logins

Adding an extra layer of protection can successfully keep hackers at bay – even if they’ve figured out your password - Set Up Automatic Backups

By doing this you can ensure that your data is recovered even in extreme cases such as ransomware or system failure. - Give Your Laptops a Security System

Firewalls, antivirus & anti-malware tools, alerts for unusual logins or transfer attempts… trick your laptop out! It will both keep your information safe AND extend the life of your computers and laptops.