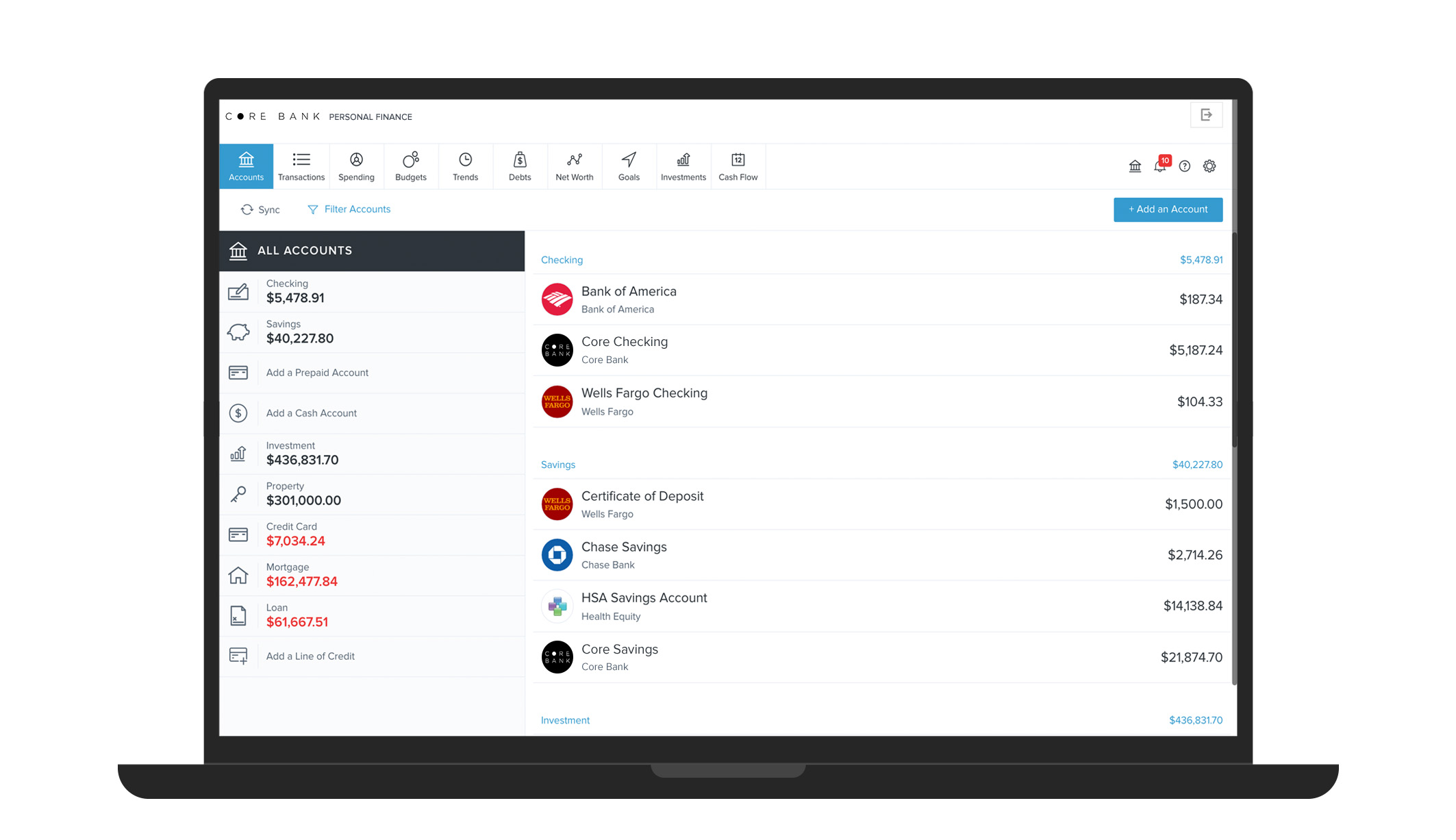

Do you find yourself feeling overwhelmed while trying to stay on top of your personal finances? Using multiple apps to track your activity is a hassle. With aggregation tools, you can kiss app switching goodbye and access all your accounts in one place. Account aggregation works by automatically gathering financial information from accounts at different institutions and bringing it all to one place. Core Bank’s new Personal Finance Management Tool does all that!

Here are seven ways aggregation tools make staying on top of your finances easier:

1. Visualize your spending

Take your transactions to the next level by looking at the highlights of how much money is going into different spending categories. All the categories are shown in a spending wheel. This helps you get a quick visual and grasp on where your money is going, so you can see where to improve.

2. Customized budgets

Feel confident, not confined by your budget. Set up your own budgets or have one created for you. Personal Finance looks at your spending trends and recommends the best budget option based on how you currently spend your money.

3. See how your finances are trending

Spending tends to vary from month to month, and it’s important to have an idea of how your spending tracks throughout the year. Take a look at how you’re trending and compare your spending categories and income trends throughout your account history.

4. Pay off your debts faster

Feel the joy of paying off the last of your debt with Personal Finance! The debt reduction tool will set and track your progress using the snowball debt pay-off method. See how fast you can pay down your first debt by logging in today.

5. See the bigger picture

Net worth is the greatest way to measure your overall financial wealth. By tracing the net sums of your assets and liabilities the net worth tool by Personal Finance can give you an instant trend line displaying your net worth.

6. Reach your goals

Whether you are saving for a new home, a vacation, or paying off debt, goals are a great way to make financial progress. Set up and track your goals on Personal Finance’s intuitive timeline; watch your progress and enjoy the wins.

7. See your future account balance

Plan for payments and predict your cash flow by seeing when recurring transactions and income are expected to happen. See when money comes and goes so you can be an excellent financial planner.

Meet the better way of managing your finances!