Should I Buy a Home Now? The question many folks are asking themselves these days… Here’s my take.

The Dollar Just Doesn’t Go as Far Anymore

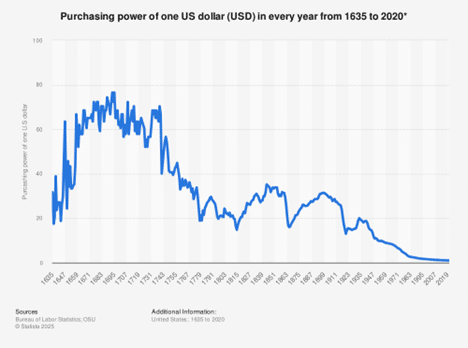

It all starts with the value of the dollar. Over time, the value of the dollar has consistently depreciated in value.

What have we been experiencing lately? Higher prices on virtually everything. At the pump, the grocery store (eggs seem to be the go-to topic of discussion), and the list goes on. But let’s look at real estate.

Home Prices and Inflation

Home prices. The same principle applies. It is now taking more dollars to buy the same goods. It is taking more dollars to purchase the same home that was a lesser amount just a few short years ago. This is a concept that is directly related to inflation. In this economic temperature, that directly means that homes will hold their value until we see some relief in inflationary pressures.

The Wait-and-See Approach

So, folks say, “Well let me stand on sidelines and once my dollar goes further (rates come down and prices come down) then I will purchase that home I have always wanted…”

Let’s flip the angle. If rates come down (your dollar goes further, and inflationary pressures begin to recede) what happens? More buyers enter the market. With more buyers, demand increases and home values either continue to stay steady or we see those prices tick up due to higher demand.

So…Should I Buy a Home Now?

So, we get back to the original question… should I buy a home now?

Let me shift your thinking. Instead of looking at this in terms of dollars, cents, and price. What if you ask yourself this question… “Am I willing to miss out on the organic appreciation of my home in the years to come?”

Real Estate is a Wealth-Building Tool

Real estate ownership is a key tool for building wealth. Owning a home is one of the most powerful long-term investments you can make. It’s about putting your hard-earned money into an asset that grows, rather than watching your purchasing power shrink over time. Now is the time to get started.

Want to discuss the idea further? Let’s chat.

June is National Homeownership Month. For information on how Core Bank’s mortgage team can support your homeownership needs, visit us online or contact us today!

Written by Brandon Fowler, Mortgage Loan Originator

NMLS # 2301485