Core Bank Blog

The Core Bank blog serves as a resource for customers to learn more about topics like financial literacy, loans, digital banking, real estate, business, and community events. We’re your go-to source for all things banking-related!

Latest Articles

A Vineyard, a Hangar and a Culinary Center? Talk about awesome networking venues!

By Tricia Luedke, Vice President, Private Banking, Core Bank Loan Production Office Core Bank had the privilege of attending some fantastic networking events in Kansas City this past month. The Vineyard We started the month attending a wine event at Stone Pillar...

Loosen up Bankers. Untie the knot!

By Jason Moxness, Market President, Core Bank Loan Production Office Last month, I was honored to represent Core Bank as we supported the Buy-Sell Seminar at Johnson County Community College hosted by the Kansas Small Business Development Center (KSBDC). It's a...

Tell Me About Yourself: A Sixteen-Year-Old’s Journey

By Stacey Huddleston, Vice President, Commercial Relationship Manager, Core Bank Loan Production Office I’m so excited! This is going to be the best interview I’ve ever conducted. My interviewee seems pretty confident, but has no idea what’s about to go down. So I...

Smart Beginnings Learning Center in Kansas City

By Michele Walters, Vice President SBA Commercial Relationship Manager, Core Bank Loan Production Office Core Bank is somewhat new to the area. We've recently launched a new loan production office this past spring. As I was ‘in training’ with my new company and team,...

Core Bank Headquarters Build

In an effort to share the construction process for our new Core Bank headquarters, customers can now view daily images of the build site. Be sure to bookmark the website and check back often to see the exciting progress. https://corebank.com/headquarters/ The new...

Circle of Hope: You’re never too young to learn about giving back.

By Tricia Luedke, Vice President, Private Banking, Core Bank Loan Production Office How old were you when you started to learn about helping people in need and giving back to the community? I remember a conversation I had with a woman many years ago about giving back....

When Business and Community Come Together, Everyone Wins.

By Alicia Walker, SBA Relationship Manager, Core Bank Loan Production Office Recently, I was invited to attend a ribbon cutting event by one of my good friends, Mark Byrd. Mark Byrd is the owner of New Reflections Technical Institution (NRTI), a school which offers...

Making My Donation Count

By Jessica Rolfes, Commercial Loan Assistant, Core Bank Five and half years ago my family’s dear friends Tony and Shannon lost their son Alfy to stillbirth at 28 weeks. Their world was obviously shattered and turned upside down. Through her pain, Shannon found a cause...

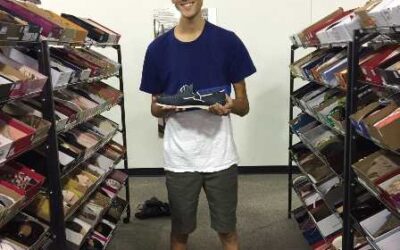

Shoes for my Dad? I’ve Got This.

By Stacey Huddleston, Vice President, Commercial Relationship Manager, Core Bank Loan Production Office My wife Kelli admits that I was relatively calm throughout our wedding planning process. She was to plan everything and just tell me when and where to be on our...

Meet the newest SBA Preferred Lender

By Jason Moxness, Market President, Core Bank Loan Production Office We’re excited to announce that as of July 19th Core Bank received notification from the SBA that we are officially approved to participate in the Preferred Lenders Program (PLP)! What is the SBA...

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.